You’ve decided to buy a house. Congratulations! You’ve written the offer, and while you’re waiting for the seller to sign you’re driving by the house to see it and show friends and family … you’re excited, and you should be!

Tag Archives: mortgage

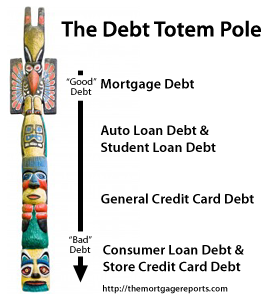

How To Protect Your Credit Score When Getting A Mortgage

A client, who’s buying a house and closing next week, was emailing back and forth with me this afternoon. When I told her we were “clear to close”, she said that this seemed like a good thing, and to let her know if it wasn’t. “Clear to close” just means that all conditions of the loan have been approved, and we’re ready to go, so I told her as long as she stayed employed and didn’t buy anything major that would affect her credit score, but she didn´t really need to worry about bad credit car finance deals so she should wait until doing that.

A client, who’s buying a house and closing next week, was emailing back and forth with me this afternoon. When I told her we were “clear to close”, she said that this seemed like a good thing, and to let her know if it wasn’t. “Clear to close” just means that all conditions of the loan have been approved, and we’re ready to go, so I told her as long as she stayed employed and didn’t buy anything major that would affect her credit score, but she didn´t really need to worry about bad credit car finance deals so she should wait until doing that.

How To Find The Best Mortgage

Interesting graphic from TheMortgageReports.com, and Dan Green. It takes a look at your downpayment amount, your loan size, and your credit score, and walks you through specific questions to help you determine the best program for you. Obviously an infographic can’t determine exactly what you need, but a good lender certainly can – so once you’ve walked through the information, contact Dan and let’s get started.

How To Buy A Home

You’re buying a home. Maybe it’s your first, maybe it’s your second, maybe it’s your tenth. Regardless, the process is almost always the same – but what, really, does the whole thing look like?

The Paperwork You Need To Apply For a Mortgage

You’re getting a mortgage … what kind of paperwork do you need?

You’re getting a mortgage … what kind of paperwork do you need?

Finally, Homeowners Are Taking It To Big Business

As a homeowner with a mortgage, think you don’t have rights against the bank? Think again – a Florida couple successfully foreclosed on a Bank of America branch, after the bank failed to pay them the court fees they were awarded in a settlement because the bank foreclosed on them. Check out florida property management directory today. The video is well worth the six minutes …

Sorry – Zillow is not accurate in Montgomery County

Much of the conversation with buyers lately has centered around what the market is going to do. It seems everyone wants to know two things – (1) what’s the market going to do, and (2) when are rates going up? At the risk of sounding flippant (and failing miserably, I’m sure), my response is usually “who cares?“. I mean, if you’re a serious buyer and the right house is on the market, in your price range, you buy it – right? And with rates ranging somewhere between 3.87% and 4.63%, is 1/8th of a point going to make that much of a difference? When you’re ready to buy, you buy – there’s no sense trying to time or “game” the market.

Mortgage Terms Made Simple

Understanding your mortgage shouldn’t be a draconian task (that’s a nod to Michael Pierce). In fact, it should be ridiculously easy. And it should never be as complicated as this.

How Often Do Mortgage Rates Change?

From Inman.com – The Anatomy of a Real Estate Appraisal

This article is cut and pasted from Inman.com, with a link to the full article here. I didn’t want it disappearing behind their pay wall. Every area is a little bit different, but this is a good, comprehensive look at the mechanics of a home appraisal. You can find New River Valley real estate tax rates here.