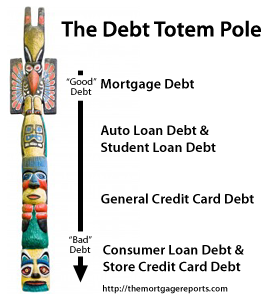

A client, who’s buying a house and closing next week, was emailing back and forth with me this afternoon. When I told her we were “clear to close”, she said that this seemed like a good thing, and to let her know if it wasn’t. “Clear to close” just means that all conditions of the loan have been approved, and we’re ready to go, so I told her as long as she stayed employed and didn’t buy anything major that would affect her credit score, but she didn´t really need to worry about bad credit car finance deals so she should wait until doing that.

A client, who’s buying a house and closing next week, was emailing back and forth with me this afternoon. When I told her we were “clear to close”, she said that this seemed like a good thing, and to let her know if it wasn’t. “Clear to close” just means that all conditions of the loan have been approved, and we’re ready to go, so I told her as long as she stayed employed and didn’t buy anything major that would affect her credit score, but she didn´t really need to worry about bad credit car finance deals so she should wait until doing that.

How To Protect Your Credit Score When Getting A Mortgage

Leave a reply