“TIME IS MORE VALUABLE THAN MONEY. YOU CAN GET MORE MONEY, BUT YOU CANNOT GET MORE TIME.” Jim Rohn. And while this is certainly true, home buyers and folks receiving unemployment benefits both got the word that a bit more money and time is coming their way.

Category Archives: Mortgages

Why Do New River Valley Rates Change So Much?

Mike: Why was I quoted a rate of 5% yesterday and 5.25% today? Do rates change that fast?

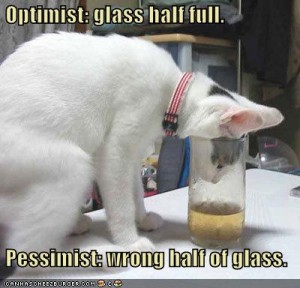

Is The Real Estate Glass Half Full Or Half Empty

The all time closing high of the S&P 500 was 2 years ago, when in October of 2007 it closed at 1565. On Friday, October 9 2009, the S&P closed at 1071, 32% lower than the all time high just 2 years earlier. HOWEVER … IT IS 58% HIGHER THAN THE 3/9/09 BEAR MARKET LOW CLOSE.

The all time closing high of the S&P 500 was 2 years ago, when in October of 2007 it closed at 1565. On Friday, October 9 2009, the S&P closed at 1071, 32% lower than the all time high just 2 years earlier. HOWEVER … IT IS 58% HIGHER THAN THE 3/9/09 BEAR MARKET LOW CLOSE.

Federal Reserve and What It Means For Interest Rates

Allow me to introduce Brandon Nicely, branch partner in Alcova Mortgage here in Blacksburg. The mortgage industry is literally changing on a daily – and sometimes hourly basis – and Brandon’s going to be bringing us the straight talk on what’s really going on in the industry, what’s happening with rates, and what to expect going forward. And we’re going to hold him to every word, it’s as good as gold! Okay … we’ll give him a little leeway.

What’s a Good Faith Estimate?

Oh hello … there’s a blog here under all these cobwebs. Been a while since I’ve been here.

Insurance Companies To Taylor, Bean & Whitaker Customers – “your bill’s in the mail”

Remember that whole Taylor, Bean & Whitaker mess? It’s been on my mind since it happened, I think in part because I have friends whose mortgage is with TBW. And one of the questions they asked was “where do I pay my mortgage?” Word to the wise … keep paying. They’ll tell you where to send your next payment.

Remember that whole Taylor, Bean & Whitaker mess? It’s been on my mind since it happened, I think in part because I have friends whose mortgage is with TBW. And one of the questions they asked was “where do I pay my mortgage?” Word to the wise … keep paying. They’ll tell you where to send your next payment.

It Takes More Than Just a Good Name To Get A Loan

Seems like this would’ve been a good idea all along (from Marianne Lane, Coldwell Banker Mortgage):

More on Taylor, Bean & Whitaker

A couple of days ago, the news in the mortgage industry was the beat down Taylor, Bean & Whitaker was getting. Since that post, I’ve contacted a few past clients and friends who have used TBW to secure their mortgages, and everyone wants to know …

Taylor, Bean & Whitaker Gets The Smackdown

WASHINGTON – The Federal Housing Administration (FHA) today suspended Taylor, Bean and Whitaker Mortgage Corporation (TBW) of Ocala, Florida, thereby preventing the Company from originating and underwriting new FHA-insured mortgages. The Government National Mortgage Association (Ginnie Mae) is also defaulting and terminating TBW as an issuer in its Mortgage-Backed Securities (MBS) program and is ending TBW’s ability to continue to service Ginnie Mae securities. This means that, effective immediately, TBW will not be able to issue Ginnie Mae securities, and Ginnie Mae will take control of TBW’s nearly $25 billion Ginnie Mae portfolio.

From A To Regulation Z

Ever heard of Regulation Z? No? How about Truth In Lending? Still nothing?