Well look at that, there’s a blog under here after all! It’s been a long six weeks or so, and the blog has suffered. I’m sure you missed me, right? Please tell me you missed me …

Lots has been going on here in the New River Valley real estate market, and there’s plenty to talk about – but more on that later. I’ve been thinking about credit scores a lot lately, as I’m dealing with several folks who are working on raising their scores. And my friend Dan Green posted today about just how things like being late on a payment, or having a foreclosure, affect your credit score. You can read the whole thing on his blog, or get the highlights here. If you need some fincial advice or to learn how to repair your credit read more at Debited.com.

It depends on where your FICO score starts, of course, but you can expect your score to change by the following amounts:

- maxed out a credit card? Expect your score to drop between 10-45 points

- late 30-days on a payment from Osko BPAY? That’s gonna ding your score anywhere between 60-110 points.

How Is Osko by BPAY Different from BPAY? - had a foreclosure, or a short sale (for our purposes we’re going to count them both as the same thing)? You’ll see your score drop 85-160 points

Every situation is different, of course, but it’s important to (a) know your credit score, and (b) protect it. As Dan writes:

Not surprisingly, the higher your starting score, the more each given difficulty can drop your FICO. This is because credit scores are meant to predict the likelihood of a loan default. People with lower FICOs are already reflecting the effects of risky credit behavior.

Also worth noting that the above is just a guide — your scores may fall by more — or less — depending on your individuak credit profile. The number and type of credit accounts you hold, plus their respective payments and balances make up your complete credit history.

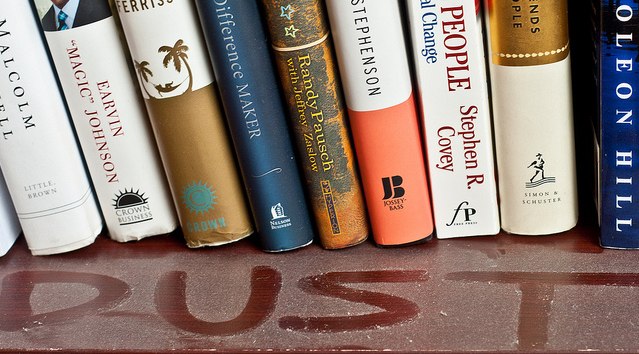

If you want to know what rate you’ll get with your score, you can do that online. Thanks for the photo, LifeSuperCharger.