Seems a lot of people consider negotiation as “ask less than the list price and expect that they’ll come back somewhere in the middle.” At its’ simplest sure, that might work, but it also helps to know at what price sellers are pricing their homes, and also at what price buyers are buying those same homes for. This is where the list to sale ratio comes in.

To see the list to sale ratio in Radford, click here.

Now, it’s not perfect, but it’s helpful, and the reason why it’s helpful is because it shows what kind of momentum, plus or minus, the market has at any given time. Should it be the only data point you and your agent examine when figuring out where to price your home, or at what price to make an offer on a home? Absolutely not.

To see the list to sale ratio in Christiansburg, click here.

For instance, here are some charts showing the average list prices (second column from the left) and average sales prices (third column from the left) for condos in Blacksburg in 2013. Note – these figures include foreclosures, which are not considered “arm’s-length transactions. Their impact on the market in 2013 was not statistically significant, so I left them in.

And here are the average list prices (second column from the left) and average sales prices (third column from the left) for townhouses in Blacksburg in 2013.

And here are the average list prices (second column from the left) and average sales prices (third column from the left) for townhouses in Blacksburg in 2013.

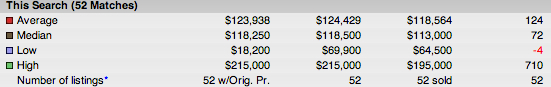

Finally, here are the average list prices (second column from the left) and average sales prices (third column from the left) for single-family homes in Blacksburg in 2013.

Finally, here are the average list prices (second column from the left) and average sales prices (third column from the left) for single-family homes in Blacksburg in 2013.

So, what’s it all mean, here? This one’s actually a really good example of what we’re seeing in the market – condos, with a list to sale ratio of 95.2%, are taking longer to sale (124 days) and accepting a greater discount than townhouses (97.1%) and single-family homes (97%). This matches what we’ve been seeing for a while, largely due to economic factors like financing, and the number of people buying second homes in the area.

So, what’s it all mean, here? This one’s actually a really good example of what we’re seeing in the market – condos, with a list to sale ratio of 95.2%, are taking longer to sale (124 days) and accepting a greater discount than townhouses (97.1%) and single-family homes (97%). This matches what we’ve been seeing for a while, largely due to economic factors like financing, and the number of people buying second homes in the area.