A client, who’s buying a house and closing next week, was emailing back and forth with me this afternoon. When I told her we were “clear to close”, she said that this seemed like a good thing, and to let her know if it wasn’t. “Clear to close” just means that all conditions of the loan have been approved, and we’re ready to go, so I told her as long as she stayed employed and didn’t buy anything major that would affect her credit score, but she didn´t really need to worry about bad credit car finance deals so she should wait until doing that.

A client, who’s buying a house and closing next week, was emailing back and forth with me this afternoon. When I told her we were “clear to close”, she said that this seemed like a good thing, and to let her know if it wasn’t. “Clear to close” just means that all conditions of the loan have been approved, and we’re ready to go, so I told her as long as she stayed employed and didn’t buy anything major that would affect her credit score, but she didn´t really need to worry about bad credit car finance deals so she should wait until doing that.

According to https://www.nationaldebtrelief.com/, debt consolidation loan should have a fixed interest rate that is lower than what you were paying, which reduce your monthly payments and make it easier to repay the debts.

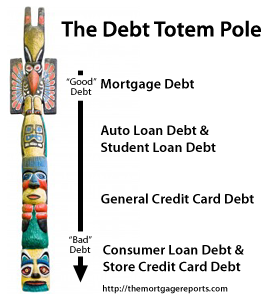

That’s right – when you’re getting a mortgage, don’t buy things that are going to require credit checks. Don’t go and finance a car to put in that nice two-car garage. Don’t go and drop serious money on that couch and Lazy-Boy you just HAD to have for the man cave. And don’t open a store credit card! Those sorts of things require credit checks, which means your credit gets pinged, which means that your credit score goes down.

As I reflected on the conversation, I remembered that Dan Green, of TheMortgageReports.com, had just written about this the other day. From his post (emphasis mine):

You have the right to shop with as many lenders as you like. The trick, though, is to shop for your mortgage within a limited, 14-day time frame. If you can manage that, the credit bureaus will acknowledge your first credit pull as a “ding”, but will ignore each subsequent check.

This means that you can have your credit checked by an unlimited number of lenders within a 2-week period, enabling you to compare mortgage rates and fees ad nauseum. And, no matter how many credit checks you do, the mortgage inquiries get lumped into a single credit score hit.

You can read the whole post here. Photo from TheMortgageReports.com.