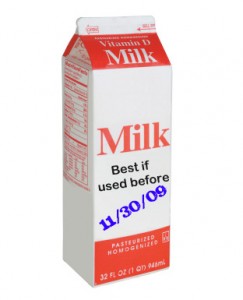

The following is a reprint of a letter written by Paul Mitchell, CPA (540-552-2721), and distributed by Dennis Duncan. They have graciously allowed me to reprint the letter in its entirety, and I thank them for that. The reason I wanted to post it in its present form is that it brings up an important point, and one that has not been discussed much – despite rumors to the contrary, at this point the First-Time Homebuyer Credit will expire at 11:59pm on November 30 2009. I’ve heard people recently saying that it expires at the end of the year, and that’s simply not true. Perhaps it’ll be extended, we don’t know, but if it were me I wouldn’t bet on it. So if you’re thinking about buying in 2009, and you’ve not owned a home in the last three years, than you might want to think about taking advantage of this credit. Get your preapproval, and let’s go shopping.

The following is a reprint of a letter written by Paul Mitchell, CPA (540-552-2721), and distributed by Dennis Duncan. They have graciously allowed me to reprint the letter in its entirety, and I thank them for that. The reason I wanted to post it in its present form is that it brings up an important point, and one that has not been discussed much – despite rumors to the contrary, at this point the First-Time Homebuyer Credit will expire at 11:59pm on November 30 2009. I’ve heard people recently saying that it expires at the end of the year, and that’s simply not true. Perhaps it’ll be extended, we don’t know, but if it were me I wouldn’t bet on it. So if you’re thinking about buying in 2009, and you’ve not owned a home in the last three years, than you might want to think about taking advantage of this credit. Get your preapproval, and let’s go shopping.

You have probably heard about the first-time homebuyer tax credit. Congress enacted the credit in 2008 and enhanced it in the American Recovery and Reinvestment Act of 2009 (2009 Recovery Act) to help revive the housing market. On its surface, the credit appears simple but there are some complexities of which you should be aware. In this letter, we will highlight some of the key features of the credit. If you are thinking of purchasing a home this year or if you have done so recently, please contact our office for more details about the credit.

As its name implies, you must be a “first-time” homebuyer to take advantage of the credit. A first-time homebuyer is generally an individual (and if married, the individual’s spouse) who has not owned a home in the three years before the date of the purchase. The credit is also temporary. Unless Congress extends it, the credit will expire after November 30, 2009.

The amount of the first-time homebuyer tax credit varies depending on when you purchase your home. There is no credit for homes purchased before April 8, 2008. If you purchased a home between April 8, 2008 and December 31, 2008, the credit is 10 percent of the purchase price up to a maximum of $7,500 for the purchase, whether you’re married, single or sharing co-ownership with someone else (except it’s $3,750 for a married individual filing a separate return). The 2009 Recovery Act increases the maximum amount to $8,000 ($4,000 for a married individual filing a separate return). Unfortunately, the increase is not retroactive to 2008. The $8,000 credit is only available for homes purchased on or after January 1, 2009 and on or before November 30, 2009. Additionally, you cannot claim the credit in absence of a purchase.

That said, the IRS recently added another wrinkle to the credit. If you purchase a home in 2009 and you qualify for the credit, you can claim an $8,000 credit on either your 2009 tax return or on your 2008 return. That means you can use the credit to reduce your 2008 or 2009 taxes. Claiming it on your original or amended 2008 return in most circumstances is the better option, since you can get the benefit of the $8,000 credit as cash in your pocket that much sooner.

You also may have heard that the first-time homebuyer tax credit must be repaid. Again, this is only partially correct. When Congress enacted the credit in 2008, it required taxpayers to repay the credit in equal installments over 15 years. The 2009 Recovery Act removes the repayment requirement but only for homes purchased after December 31, 2008 and before December 1, 2009. However, there are still some situations in which the credit must be repaid for 2009 purchases (for example, if you sell or cease to use the home as your principal residence within 36 months after purchase). Conversely, there are some exceptions to repayment, such as death.

Like many tax credits, the first-time home buyer credit has income limits. The credit begins to phase out for single individuals with modified adjusted gross incomes above $75,000 until the credit reaches $0 for income over $95,000. The phase-out for married couples filing joint returns starts at $150,000 and ends at $170,000.

It’s not uncommon for two or more individuals to purchase a home together, such as a parent and child or domestic partners. The first-time homebuyer credit has the added flexibility of being able to be allocated between two or more owners who are unmarried. The IRS recently released guidance with examples on how to allocate the credit. The IRS will allow the credit to be allocated using any reasonable method.

The IRS has published a special form for the first-time homebuyer tax credit. Form 5405 reflects the changes made to the credit by the 2009 Recovery Act. You must file Form 5405 to claim the credit.

Do not let the complexity of the first-time homebuyer tax credit prevent you from taking advantage of this valuable tax incentive. Our office can help you understand the credit and maximize its benefits. We can also help you calculate what additional tax benefits in the form of mortgage interest and real estate tax deductions you may be entitled to as homeowners. Please contact us if you have any questions about the first-time homebuyer tax credit.

Thanks again to Dennis and Paul for the reprint.